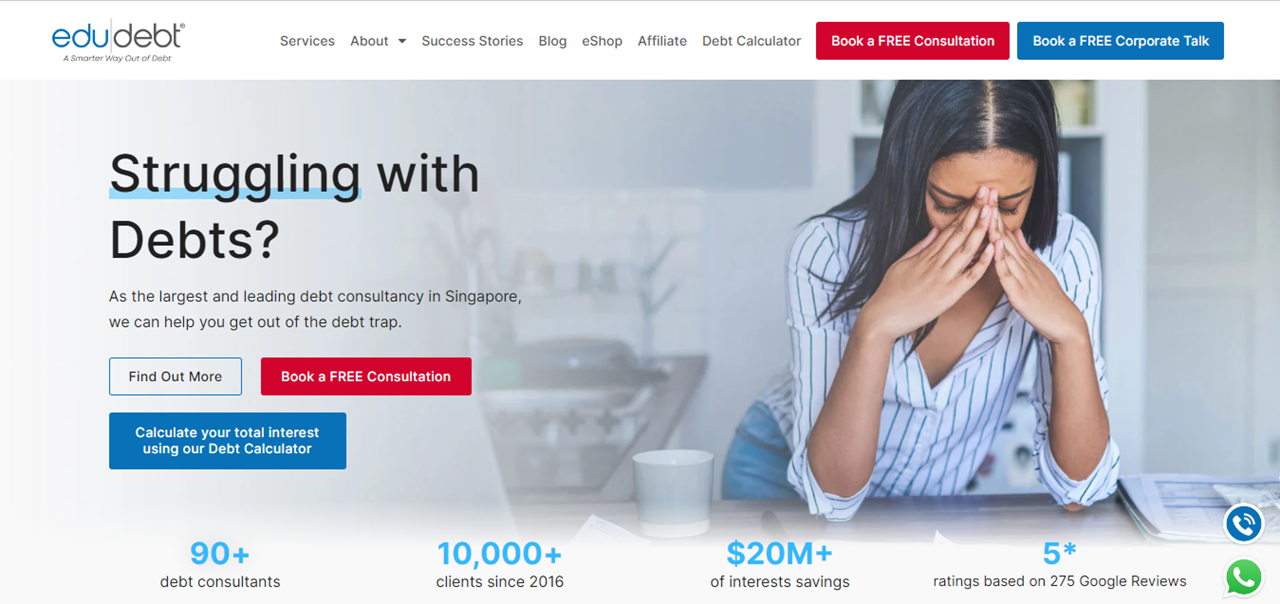

Debt management is an essential skill in today’s economic environment. As individuals strive for financial freedom, understanding and managing debt becomes a critical step towards achieving long-term financial health. EDUdebt emerges as a pivotal resource in this journey, offering tools and guidance tailored to help you navigate the complexities of debts effectively. This guide delves into how EDUdebt can empower you to master your debts and pave the way to financial independence.

Understanding Debt

Before delving into management strategies, it is crucial to understand what debt is and how it affects your financial health. EDUdebt is money borrowed by one party from another, often with the agreement that it will be paid back with interest. While debt can be a useful financial tool for managing cash flow and making significant purchases, it can also become a burden if not handled properly.

Types of Debt

- Secured Debt: This involves collateral, such as a home in a mortgage or a car in an auto loan. Failure to repay can lead to the seizure of the collateral.

- Unsecured Debt: This does not involve collateral and includes most credit card debt, student loans, and medical bills.

How EDUdebt Helps

EDUdebt offers comprehensive solutions to manage various types of debt effectively. With a focus on education and empowerment, EDUdebt equips you with the necessary tools to understand your debt better and make informed decisions.

Debt Assessment Tools

EDUdebt provides detailed assessment tools that help you understand your total debt load, the interest rates applicable, and the repayment timeline. These tools are designed to give a clear picture of your current financial status and how your debt impacts your financial goals.

Customized Debt Management Plans

Recognizing that each individual’s financial situation is unique, EDUdebt offers personalized debt management plans. These plans consider your income, debt load, and financial goals to create a realistic pathway towards debt repayment.

Budgeting for Debt Repayment

A crucial aspect of debt management is budgeting. EDUdebt’s budgeting tools help you allocate your resources efficiently to prioritize debt repayment. This section of the guide outlines effective budgeting strategies that can accelerate your journey to becoming debt-free.

Creating a Budget

Start by listing your income sources and expenses. EDUdebt’s budgeting tools can assist in categorizing your expenses and identifying areas where you can cut back to free up more money for debt repayment.

Importance of an Emergency Fund

While repaying debt, it is also vital to build an emergency fund. EDUdebt advises setting aside a small portion of your income into a separate savings account before making extra debt payments. This fund acts as a financial cushion, reducing the need to take on new debt in case of unexpected expenses.

Strategic Debt Repayment

EDUdebt advocates using proven strategies like the Debt Snowball or Debt Avalanche methods, depending on your specific circumstances.

Debt Snowball Method

This method involves paying off debts from smallest to largest, regardless of interest rate. The psychological wins of clearing smaller debts can motivate you to tackle larger debts with more vigor.

Debt Avalanche Method

This method focuses on paying off debts with the highest interest rates first, which can save you money over time on interest payments.

Monitoring and Adjusting Your Plan

Your journey to debt freedom is not static. EDUdebt provides continuous monitoring tools that help you track your progress and make adjustments to your plan as needed. Regular reviews ensure that you stay on track or make necessary adjustments based on changes in your financial situation.

Conclusion: Achieving Financial Freedom

Mastering debt is a critical component of achieving financial freedom. With EDUdebt’s comprehensive tools and personalized guidance, you can navigate the challenges of debt management and make informed decisions that pave the way to a debt-free life. Embrace the journey with EDUdebt, and take control of your financial destiny, one step at a time.

By understanding, strategizing, and continuously adjusting your approach to debt management, you can effectively use EDUdebt’s resources to achieve and maintain financial independence.